If you’re just starting to take control of your financial life, congratulations — that’s the first step toward a more stable, peaceful, and free future. But like any new journey, the beginning often comes with stumbles. The good news? Many of the most common mistakes are easy to predict — and to avoid.

In this article, we’ll walk you through the 10 most frequent mistakes beginners make in personal finance and show you how to avoid them with simple, practical tips.

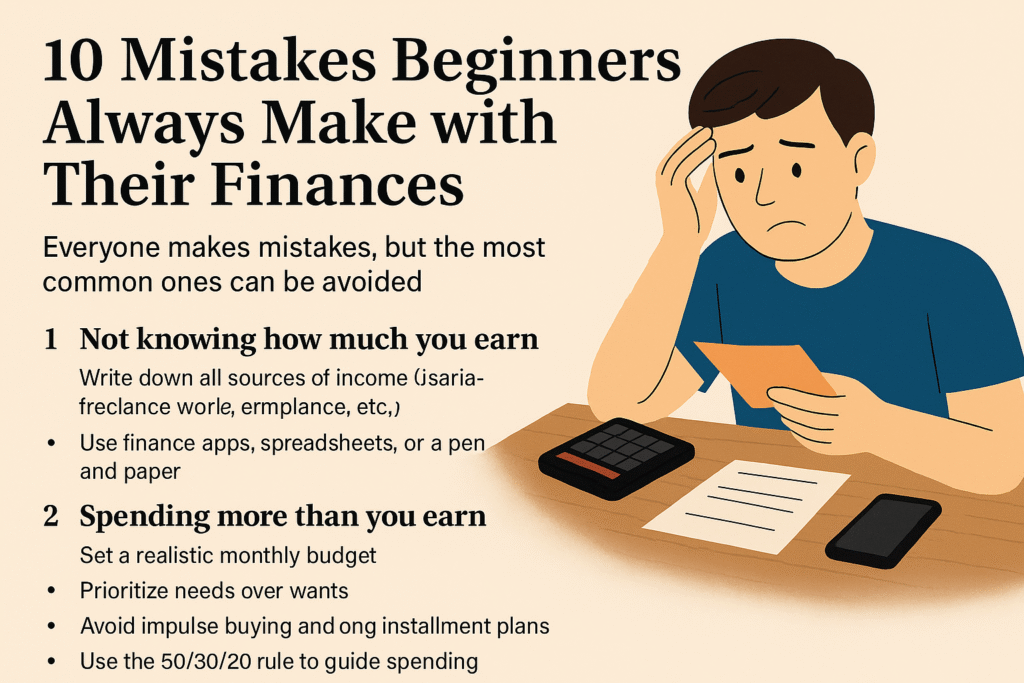

1. Not knowing how much you earn and spend

A lot of people have no idea how much money comes into their account each month — and even less about how much goes out. This lack of clarity makes financial control almost impossible.

How to avoid it:

- Write down all sources of income (salary, freelance work, side gigs)

- Track every expense — even the small ones

- Use finance apps, spreadsheets, or even pen and paper

- Review your finances weekly

2. Spending more than you earn

The classic mistake: living a lifestyle that your income can’t support. This often happens without noticing, especially when you use your credit card too much or commit to long-term payments.

How to avoid it:

- Set a realistic monthly budget

- Prioritize needs over wants

- Avoid impulse buying and long installment plans

- Use the 50/30/20 rule to guide your spending

3. Relying on your credit card limit or overdraft

Your credit limit is not extra income. Neither is your overdraft. Using these as part of your monthly finances shows a lack of balance.

How to avoid it:

- Only use your credit card if you can pay the full bill

- Build an emergency fund for unexpected expenses

- Monitor your card spending weekly

4. Paying only the minimum on your credit card bill

This is one of the most dangerous habits. Paying just the minimum means interest piles up quickly — and your debt snowballs.

How to avoid it:

- Always aim to pay your full bill

- If you can’t, stop using the card until you’re debt-free

- Try negotiating with your bank or transferring your debt to a lower-interest loan

5. Not having an emergency fund

Unexpected things happen: illness, job loss, car trouble. Without a safety net, debt becomes inevitable.

How to avoid it:

- Start saving a fixed amount every month, even if it’s small

- Aim to save 3–6 months of your fixed expenses

- Keep your emergency fund in a safe, liquid investment

6. Not creating a monthly budget

Without a plan, your money disappears before you know it. A budget is your financial map — it shows where your money is going and where you can improve.

How to avoid it:

- List all income and expenses

- Create categories (fixed, variable, non-essential)

- Set limits for each category

- Review and adjust monthly

7. Ignoring small expenses

You’ve heard the saying “small leaks sink big ships.” Tiny daily expenses may seem harmless, but they add up quickly.

How to avoid it:

- Track everything, even your coffee or quick snacks

- Do a weekly audit of small purchases

- Set a spending cap for this category

8. Not setting financial goals

Without clear goals, it’s easy to lose motivation, spend impulsively, and abandon financial control altogether.

How to avoid it:

- Set realistic, time-bound goals

- Example: Save $200 a month to reach $1,000 in 5 months

- Break big goals into smaller, more manageable steps

9. Not learning about finances

Many people think they’re “just bad with money,” so they avoid the topic. But financial education is accessible — and life-changing.

How to avoid it:

- Watch YouTube channels like “Me Poupe!” (available with English subtitles)

- Read finance blogs and listen to podcasts

- Join online communities about money

- Read books like Rich Dad Poor Dad or The Richest Man in Babylon

10. Comparing your life to others

Social media is a highlight reel. Comparing your life to filtered posts can lead to frustration — and unnecessary spending to “keep up.”

How to avoid it:

- Focus on your progress, not others’

- Compare yourself to who you were 6 months ago

- Remember: flashy lifestyles often hide financial struggles

Conclusion: Learning from other people’s mistakes is smart

You don’t have to make all the mistakes to learn. Many people have already been through these struggles and are sharing what worked — and what didn’t. Learning from them saves you time, money, and stress.

If you’re just starting, the most important thing is simply to begin. Mistakes will happen, but correcting your path is what leads to growth.

Stay organized, educate yourself, set goals, and practice. Over time, you’ll see that managing your money isn’t a burden — it’s a way to live with more peace and confidence.